CERN issues two types of invoices: periodic (automatic) invoices and ad-hoc requests for external funds (RFFs):

- Periodic invoices are used for third-party accounts which work on a reimbursement scheme i.e., CERN advances the funds and the institution who is the account holder reimburses by paying the invoices. They are generally used for Visiting Research Team accounts.

- Request for External Funds (RFFs) are invoices generated manually through the Appel de fonds externes (RFF) / Request For External Funds (RFF) form in EDH. On third-party accounts, they aim at providing funds in advance and are generally used for Collaboration accounts. RFF invoices are also used to send invoices for CERN sales orders.

It is not authorized to transfer funds to a third-party account without an invoice. Payment must be done by bank transfer and mention the invoice reference(s).

The FAP Department is the only entity entitled to receive revenue, to issue invoices (including “pro forma” invoices, except for duly authorized services), and to issue receipts (if needed).

1. Invoicing

1.1. Periodic invoices

Periodic invoices aim at recovering funds advanced by CERN on a third-party account. They summarise the expenses paid by CERN on behalf of the institution. Though they are mostly used for Visiting Research Team accounts, they may apply to some Collaboration accounts when agreed with the Accounts Receivable Service.

a) Issuance and reminders

Periodic invoices are created automatically and sent after each month's book closing, except in the following cases:

- the cumulated expenses since the last invoice are lower than 500 CHF (January to November);

- the balance of the third-party account is positive due to advance funding (see RFF on Visiting Research Team accounts below).

All expenses incurred during the year will be invoiced with the periodic invoice of December at the latest even when the cumulated amount is lower than 500 CHF (or negative, with the issuing of a credit note).

In the event of unpaid invoices, the Account Manager and the Accounts Payable Service of the debtor would receive a notification that highlights the outstanding invoices from the Accounts Receivable Service.

To allow CERN to continue providing this service, it is important that the amounts due are paid by the institutions within 30 days. If the third-party account remains negative and periodic invoices are not paid on time, expenditure requests may be blocked. CERN reserves the right to suspend or close a third-party account for which invoices are unpaid.

N.B. In exceptional circumstances, it might happen that the invoices are paid directly by a governmental body. This shall be justified in writing, along with evidence that the funds are secured (e.g. agreement between the funding body and the institution). This does not waive the responsibility of control and reporting of the institution, Account Manager and signatories.

The institution remains the sole legal debtor until the invoices addressed to a governmental body are paid.

b) Sending out invoices

The Account Manager and the Accounts Payable Service (as registered on the Account Manager website) receive the invoice in pdf format as an attachment to a notification email when a new periodic invoice is issued. The email also indicates the account balance.

The payment status of recurrent invoices can be monitored on a daily basis by the Account Manager using the CERN Expenditure Tracking (CET) tool in the Cashflow transactions table. From here, all archived invoices can also be downloaded by clicking on the green "money" icon (not the blue hyperlink).

More information on access rights are available in the procedure Roles, access and signature rights.

c) Details of amounts invoiced

The periodic invoice summarises the expenses incurred on the third-party account since the last one. The Account Manager has access to the details of the amounts via various financial applications:

- EDH (DAI, TID, Claims etc.),

- CET Team Transactions,

- CET Stores Details,

- CET Telephone Details.

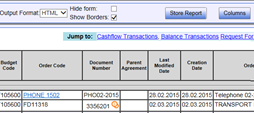

In some cases, the original invoices received from external suppliers can be consulted directly in CET. An orange symbol will then appear in the "Document number" column (see screen shot below). Clicking on the orange icon will link to the supplier invoice.

If the "Document number" column does not appear in CET, make sure the relevant check box is ticked under the "Columns" button (see top right-hand corner in the screenshot below).

|

|

If the supplier invoice cannot be found, or for further clarification on invoices that CERN has received from external suppliers, you should contact the CERN Accounts Payable Service.

It is the responsibility of the Account Manager to provide supporting documents (EDH requests, supplier invoices etc.) if requested by the institution.

1.2 Requests for external funds

Requests for Fund (RFFs) invoices aim at providing funds in advance to a third-party account or for CERN to receive payment from clients for sales orders and agreements. The invoice requests are initiated and approved in EDH by budget holders, experiment resources coordinators and DPOs expecting payment. The Accounts Receivable Service will verify the justification of the request and issue the invoices.

More information can be found in the RFF User guide.

The use of RFFs is subject to different rules depending on the type of budget code or third-party account, as described in the following paragraphs:

a) On Collaboration accounts

Requests for funds are mainly used for Research Collaborations funded from several sources. The amounts due should be defined in the official documents of the collaborations (Memorandum of Understanding and/or financial plans approved in Research Review Board / Finance Review Committee). The justification for the invoice shall be indicated in the RFF, this can be an hyperlink to a RRB, FRC or MoU document defining the contributions expected from the invoiced entity. Other justifying documents can also be attached to the RFF document.

It is the responsibility of the Resource Coordinator of the Collaboration to initiate the request for funds (RFFs) and to contact the debtor in case of late payment.

The Accounts Receivable Service can help to send out reminders if requested by the collaboration.

b) On Visiting Research Team accounts

Third-party accounts opened as Visiting Research Team accounts are set up to function with monthly periodic invoices (see 1.1.a) and should normally not use requests for funds (RFFs). However, some institutions might wish to transfer funds in advance and decrease the number of payments per year.

RFFs are authorised in order to transfer funds in advance on a Visiting Research Team account as long as the positive cash balance does not exceed one year of spending (taking into account the estimated expense budget of the on-going year).

It is not permitted to accumulate funds on a Visiting Research Team account. CERN reserves the right to return funds to the institution when the cash balance exceeds the foreseen amount of annual spending.

Reminders are in general not sent out for RFFs on Visiting Research Team accounts.

N.B. No periodic invoice is sent from January to November when an advance payment has been done for the year and no credit note has been issued. No payment is expected when the cash balance of the Visiting Research Team account is positive.

Third-party accounts cannot be used to bypass national or international Financial Regulations, especially EU Tax and Anti Money Laundering Regulations. Consequently:

- All invoices from a Visiting Research Team account must be issued to the institution which opened the account (more details on 1.1.a).

- Only payments from the institution which opened the account can be allocated to a Visiting Research Team account.

- Institutions cannot issue invoices in their name (i.e. with the institute’s header) which stipulates that the payment should be done on a Visiting Research Team account.

- Institutions cannot issue invoices in their name (i.e. with the institute’s header) with a CERN bank account as recipient of the payment.

- No sales are allowed from a Visiting Research Team account. In the event of a sale of equipment/material purchased on a Visiting Research Team account, the Account Manager should contact the Accounts Receivable Service.

- No financial transactions (including TIDs) are allowed between Visiting Research Team accounts of different institutions, unless they aim at correcting a mistake in the account used for a former transaction. N.B. Transfers between two Visiting Research Team accounts of the same institution are authorized if the transaction is approved by the Account Manager(s).

- No CERN funds should be transferred to a Visiting Research Team account, with or without an invoice.

c) On CERN budget codes

Rules for RFF invoicing on CERN budget codes are defined in the procedure Revenue from the sale of goods and services by CERN (external request for funds – RFF).

2. Settlement of invoices

2.1 Bank transfer

Any payment to CERN must correspond to an invoice.

Invoices shall be paid within 30 days in Swiss francs or in the currency indicated on the invoice by bank transfer. Cheque payments must be avoided.

It is recommended to group payments to avoid bank charges.

The invoice number(s) must be stated in the bank transfer reference and shall be used in every correspondence with CERN.

2.2 CERN bank details and currency

Bank details are indicated on the invoice. CERN has several bank accounts in different currencies, and the institutions are required to pay attention to the invoice currency and related bank account. Paying in another currency than the one of the bank account may result in exchange losses or additional bank charges for the payer.

The Swiss franc is the official currency of CERN. Consequently, all amounts are reported in Swiss francs.

Periodic invoices are issued in Swiss francs. RFFs can be issued in other currencies, provided that the payments received are in the same currency as the RFF. In the event of payments in other currency than the invoice, the amount converted in Swiss franc according to CERN's accounting rules is the one that prevails. The exchange rate risk is born solely by the institutes/funding agencies.

3. VAT exemption

For more information concerning the CERN VAT:

| No revision | Modifications | Approved |

|---|---|---|

| 1 | Technical description to initiate the RFF moved to the procedure "Revenue from the sale of goods and services by CERN (external request for funds – RFF)". | 20.06.2016 |

| 2 | Clarification General and new 1.2. c) Advance payments for Visiting Research Team Accounts. | 18.05.2017 |

| 3 | Update 3.2 VAT exemption | 06.10.2017 |

| 4 | Complete revision | 17.01.2018 |

| 5 | Introduction of Third-Party Account instead of Team Account | 01.10.2019 |

| 6 | The FAP Department is the only entity entitled to receive revenue, to issue invoices (including “pro forma” invoices, except for duly authorized services), and to issue receipts (if needed). | 14.05.2020 |

| 7 | All archived invoices are downloadable from CET. | 01.03.2021 |

| 8 | The format of invoices sent by CERN changed. | 10.03.2021 |

| 9 | Complete revision of the procedure. | 06.07.2022 |